Your Bearish reversal candlestick patterns images are available in this site. Bearish reversal candlestick patterns are a topic that is being searched for and liked by netizens today. You can Download the Bearish reversal candlestick patterns files here. Download all free photos and vectors.

If you’re searching for bearish reversal candlestick patterns images information related to the bearish reversal candlestick patterns keyword, you have come to the right site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

Bearish Reversal Candlestick Patterns. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower. For a complete list of bullish and bearish reversal patterns see Greg Morris book Candlestick Charting Explained. A single candlestick pattern with no or very little body and wicks on both sides of the body. So lets dive in and understand 3 major candlestick patterns that show bearish sentiment.

Are You Familiar With These Candlestick Patterns Great Way To Find Reversals On Longer Time Frames D In 2021 Candlestick Patterns Trading Charts Stock Chart Patterns From pinterest.com

Are You Familiar With These Candlestick Patterns Great Way To Find Reversals On Longer Time Frames D In 2021 Candlestick Patterns Trading Charts Stock Chart Patterns From pinterest.com

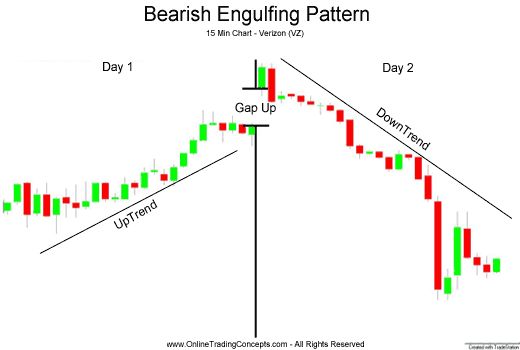

When a bearish reversal is at hand traders may want to consider closing out long positions possibly moving up their stop losses or initiating some short positions. The second candle is a bearish red candle that engulfs the body of the first candle. The first candle is a bullish green candle thats usually medium-sized. Bearish engulfing pattern. Bearish reversal candlestick patterns typically appear at the end of an uptrend. These patterns can show the possibility of a price reversal during an uptrend or the continuation of a downtrend already in place.

The bigger the difference in the size of the two candlesticks the stronger the sell signal.

The bearish Harami reversal is recognized if. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower. The second candlestick is bearish and should open above the first candlesticks high and close below its low. The bearish engulfing pattern is a two-candlestick reversal setup. In a bearish engulfing there is first a. Bearish Engulfing candlestick pattern.

Source: pinterest.com

Source: pinterest.com

The first candlestick is bullish. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Based on these patterns we can gain useful insights like if the market is bottoming or the current trend is weakening and is going to reverse. For a complete list of bullish and bearish reversal patterns see Greg Morris book Candlestick Charting Explained. A single candlestick pattern with no or very little body and wicks on both sides of the body.

Source: pinterest.com

Source: pinterest.com

The second candle is a bearish red candle that engulfs the body of the first candle. This is a 2-candle pattern. A bearish reversal pattern happens during an uptrend and indicates that the trend may reverse and the price may start falling. When a bearish reversal is at hand traders may want to consider closing out long positions possibly moving up their stop losses or initiating some short positions. It can be a Hammer candlestick or any other bullish reversal candlestick patterns.

Source: pinterest.com

Source: pinterest.com

This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. The bearish engulfing pattern is a two-candlestick reversal setup. A bearish reversal pattern happens during an uptrend and indicates that the trend may reverse and the price may start falling. BEARISH EVENING DOJI STAR. Harami is a trend reversal candlestick pattern consisting of two candles.

Source: pinterest.com

Source: pinterest.com

It has the exact opposite appearance of the bullish engulfing pattern. The first candlestick is bullish. Based on these patterns we can gain useful insights like if the market is bottoming or the current trend is weakening and is going to reverse. A hammer candlestick is a candlestick formation that is used by technical analysts as an indicator of a potential impending bullish reversal. This pattern often occurs around resistance levels.

Source: pinterest.com

Source: pinterest.com

That signals possible bearish reversal by taking place near any resistance level. There are a number of candlestick patterns used by technical traders to spot bullish reversal. Bearish reversal candlestick patterns typically appear at the end of an uptrend. Small real body near the top of candle. A single candlestick pattern with no or very little body and wicks on both sides of the body.

Source: pinterest.com

Source: pinterest.com

Bearish reversal candlestick patterns typically appear at the end of an uptrend. The reliability of these formations as always depends very much on the timeframe and the instrument however it can also be noted that in an established downtrend bearish. There can be single bearish candles or bearish candlestick patterns containing multiple candles in row. It has the exact opposite appearance of the bullish engulfing pattern. When a bearish reversal is at hand traders may want to consider closing out long positions possibly moving up their stop losses or initiating some short positions.

Source: pinterest.com

Source: pinterest.com

A bearish reversal pattern happens during an uptrend and indicates that the trend may reverse and the price may start falling. Bearish reversal patterns indicate a change in direction of a financial instrument from an uptrend to a downtrend. Small real body near the top of candle. Based on these patterns we can gain useful insights like if the market is bottoming or the current trend is weakening and is going to reverse. Here is a quick review of most famous bearish reversal candlestick patterns in technical analysis.

Source: pinterest.com

Source: pinterest.com

This is a 2-candle pattern. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. A single candlestick pattern with no or very little body and wicks on both sides of the body. This pattern forms a strong reversal signal as the bearish price action utterly engulfs the bullish one. Small real body near the top of candle.

Source: pinterest.com

Source: pinterest.com

So lets dive in and understand 3 major candlestick patterns that show bearish sentiment. This article will focus on the other six patterns. Bearish reversal patterns indicate a change in direction of a financial instrument from an uptrend to a downtrend. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower. The Bullish reversal patterns like Hammer Inverted hammer Bullish engulfing Piercing line Morning star Three white soldiers and the Bearish reversal patterns like Hanging man Shooting star Bearish engulfing Evening star Three black crows and Dark cloud cover have been explained in detail with examples.

Source: pinterest.com

Source: pinterest.com

The second candle is short and its body is completely engulfed. A single candlestick pattern with no or very little body and wicks on both sides of the body. These patterns can show the possibility of a price reversal during an uptrend or the continuation of a downtrend already in place. The second candlestick is bearish and should open above the first candlesticks high and close below its low. Most require bearish confirmation.

Source: pinterest.com

Source: pinterest.com

The second candlestick is bearish and should open above the first candlesticks high and close below its low. For a complete list of bullish and bearish reversal patterns see Greg Morris book Candlestick Charting Explained. The first candle is long and bullish and continues the uptrend. A bearish reversal pattern happens during an uptrend and indicates that the trend may reverse and the price may start falling. Harami is a trend reversal candlestick pattern consisting of two candles.

Source: pinterest.com

Source: pinterest.com

The first candle is long and bullish and continues the uptrend. The first candle is a bullish green candle thats usually medium-sized. Bearish reversal patterns indicate a change in direction of a financial instrument from an uptrend to a downtrend. The bigger the difference in the size of the two candlesticks the stronger the sell signal. It has the exact opposite appearance of the bullish engulfing pattern.

Source: pinterest.com

Source: pinterest.com

Bearish reversal candlestick patterns typically appear at the end of an uptrend. An engulfing is a two-candle pattern that can signal a major reversal at market extremes. The first candlestick is bullish. That signals possible bearish reversal by taking place near any resistance level. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one.

Source: pinterest.com

Source: pinterest.com

A hammer candlestick is a candlestick formation that is used by technical analysts as an indicator of a potential impending bullish reversal. The second candlestick is bearish and should open above the first candlesticks high and close below its low. Here are the top bearish reversal candlestick patterns. This pattern forms a strong reversal signal as the bearish price action utterly engulfs the bullish one. This pattern often occurs around resistance levels.

Source: pinterest.com

Source: pinterest.com

The Bullish reversal patterns like Hammer Inverted hammer Bullish engulfing Piercing line Morning star Three white soldiers and the Bearish reversal patterns like Hanging man Shooting star Bearish engulfing Evening star Three black crows and Dark cloud cover have been explained in detail with examples. The second candlestick is bearish and should open above the first candlesticks high and close below its low. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. They suggest that momentum has dissipated and soon the trend will turn bearish. The first candlestick is bullish.

Source: pinterest.com

Source: pinterest.com

A bearish reversal pattern happens during an uptrend and indicates that the trend may reverse and the price may start falling. A hammer candlestick is a candlestick formation that is used by technical analysts as an indicator of a potential impending bullish reversal. The first candlestick is bullish. Hammer 1 Inverted Hammer 1 Morning Star 3 Bullish Abandoned Baby 3 The hammer and inverted hammer were covered in the article Introduction to Candlesticks. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower.

Source: ro.pinterest.com

Source: ro.pinterest.com

The first candlestick is bullish. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. When these candlestick patterns form they suggest the market is about to correct signaling traders to take action. The bigger the difference in the size of the two candlesticks the stronger the sell signal. Bearish Engulfing Pattern.

Source: pinterest.com

Source: pinterest.com

The second candlestick is bearish and ought to open above the high of the first candlestick and close beneath its low. Bearish reversal candlestick patterns typically appear at the end of an uptrend. Color of the body is not important. The bearish Harami reversal is recognized if. Most require bearish confirmation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bearish reversal candlestick patterns by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.